Focused on Growth

We partner with proven operators to grow strong Canadian companies

Get To Know Us

Established in 2012, SeaFort is a growth-oriented investor that seeks to establish long-term partnerships.

We provide financial and strategic support to help Canadian businesses grow. Our mission is to partner with entrepreneurs to help them grow their businesses into industry-leading Canadian companies. Founded in 2012, SeaFort is a top-performing private equity manager and is currently investing its second fund.

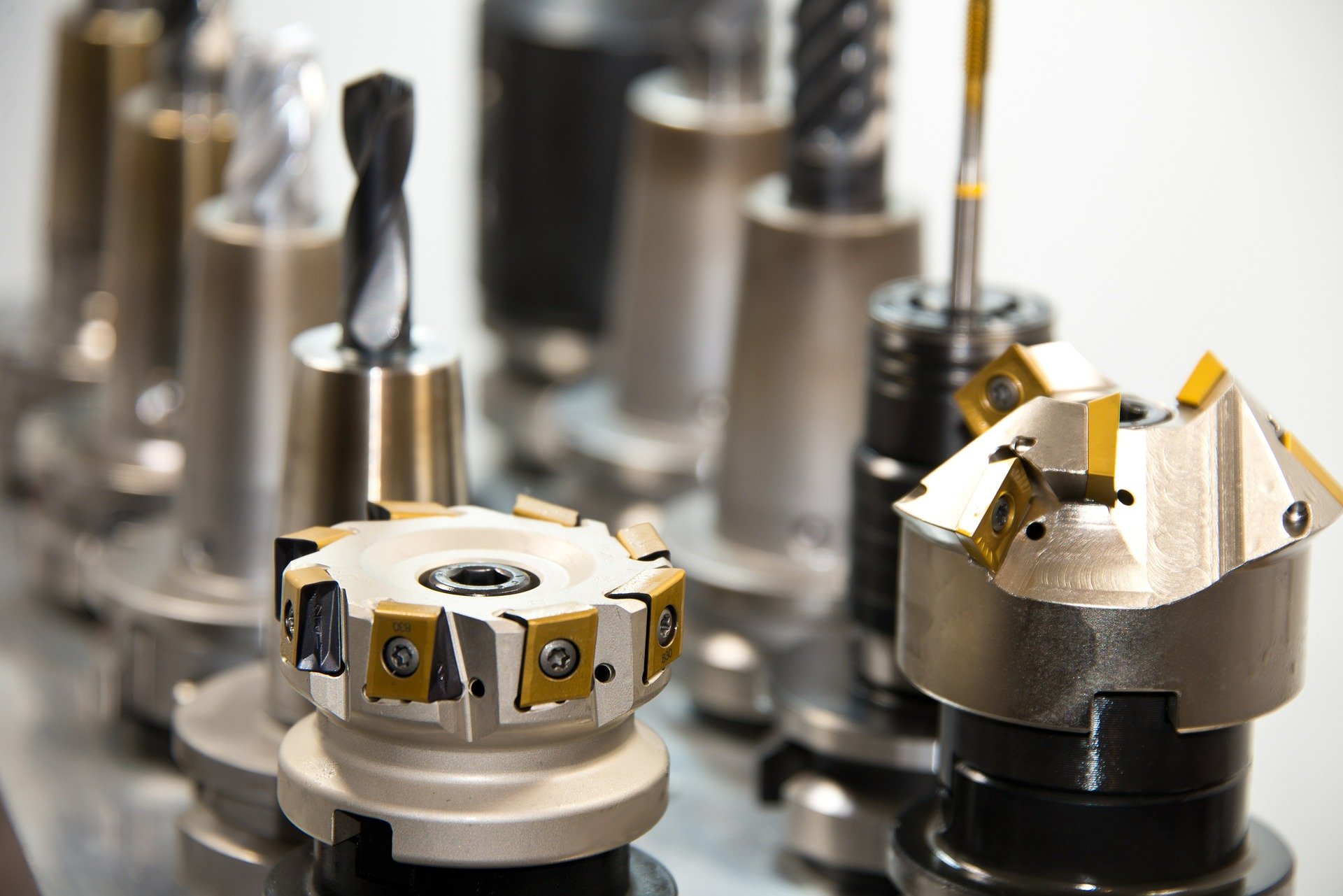

We partner with entrepreneurs to execute on clearly defined growth plans. We have expertise in supporting the development and execution of strategic plans as well as executing on organic and inorganic growth opportunities. We primarily seek to invest in the business services and industrial sectors.

Our Roots

SeaFort’s founding investors include members of two of the most prominent Canadian business families.

Our founding investors include members of the Sobey and McCain families. Having established and grown world class Canadian-based businesses, these individuals support long term value creation and are committed to well defined core values.

At SeaFort we understand the importance of legacy and we take a genuine partnership-based approach in our dealings with the stakeholders in each of our businesses.

A Canadian Focus

From our Halifax office, we exclusively invest in Canadian-headquartered businesses. Through our existing partnerships, we have a coast-to-coast presence which gives us local knowledge and relationships in every Canadian market.

Partner With Us

Learn more about SeaFort’s investment style and what it means to be a SeaFort partner.